Calculating the Cost of Goods Sold for Efficient Financial Management

5 Reading minutes

In the intricate world of business finance, calculating the cost of goods sold (COGS) is a crucial aspect that provides insight into the direct expenses associated with the production of goods or services.

It is an indispensable metric for any business aiming for financial transparency and strategic decision-making.

What is the Cost of Goods Sold?

Understanding the importance of COGS begins with grasping its essence. COGS, also known as COCS (cost of goods consumed), represents the overall expenses involved in producing the goods or services sold by a business within a specific timeframe.

The Importance of Calculating the Cost of Goods Sold

Calculating the COGS helps you:

Enhancing Profitability

Accurate COGS calculations are pivotal for determining the gross profit margin, a key indicator of a business’s financial health.

It aids in establishing an optimal pricing strategy by factoring in production costs, ensuring profitability while remaining competitive.

Strategic Decision-Making

For investors, lenders, and business owners, COGS is a critical metric for financial analysis. It provides insights into operational efficiency, helping make informed decisions regarding production processes, inventory management, and overall business strategy.

Financial Reporting and Analysis

In the realm of financial reporting, understanding and calculating the cost of goods sold is indispensable.

It forms the basis for generating accurate financial statements, aiding investors, stakeholders, and analysts in evaluating a company’s financial health.

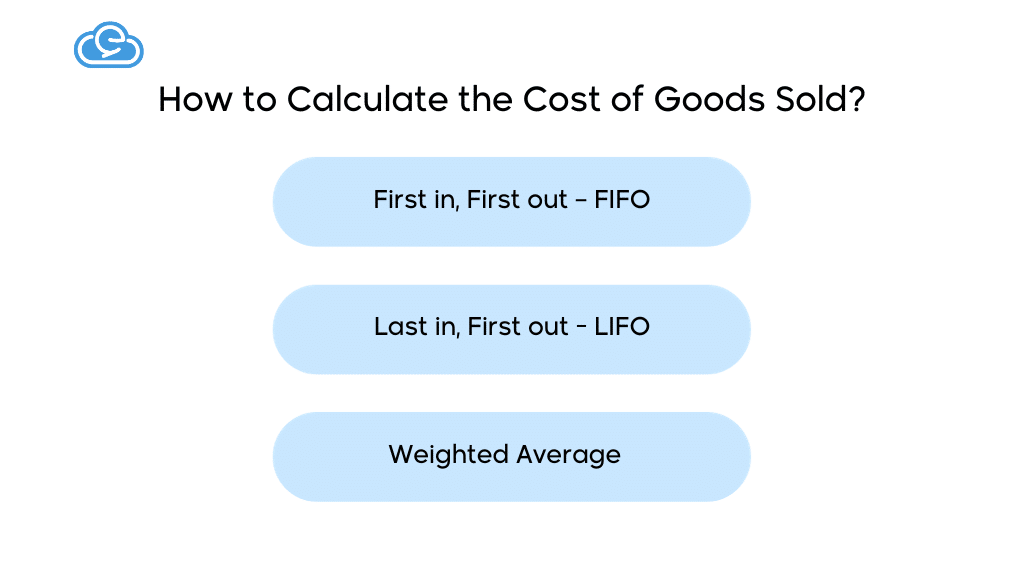

How to Calculate the Cost of Goods Sold?

The determination of the goods’ value sold is contingent upon the approach employed by the organization to assess inventory value.

Numerous methods exist for inventory calculation, with the most prominent ones being:

1. First in, First out – FIFO

It is an inventory valuation method that operates on the principle of chronological order. In this approach, the first items added to the inventory are assumed to be the first ones sold.

As a result, calculating the cost of goods sold (COGS) is based on the earliest costs incurred, providing a straightforward and chronological approach to valuing inventory.

FIFO is particularly useful in industries where product shelf life is a crucial consideration, as it ensures that older inventory is utilized first.

2. Last in, First out – LIFO

It is a method used to assess the cost of goods sold (COGS), where the most recently acquired or produced items are considered the first to be sold or used.

In essence, it assumes that the last items added to inventory are the first to be removed. This method is particularly useful in times of rising prices, as it reflects current market conditions more accurately.

While widely used in certain industries, LIFO can also present challenges in accurately representing the true cost of goods sold, especially when inventory turnover is high.

3. Weighted Average

The weighted average is a method of calculating the average cost of goods or services by taking into account both the quantity and the unit cost.

This method assigns weights to different cost components based on their proportional contribution to the total cost, providing a more balanced representation of overall expenses.

In the context of cost of goods sold (COGS), the weighted average method considers the total cost of goods available for sale, dividing it by the total number of units.

This approach ensures that variations in costs are appropriately reflected, offering a comprehensive and fair calculation of the average cost per unit.

Exceptions to Calculating the Cost of Goods Sold

The calculation of the cost of goods sold is typically associated with businesses engaged in the production and sale of tangible goods.

However, certain fields operate outside this paradigm, where there are no physical goods to produce or sell. In these cases, the cost of goods sold calculation does not apply.

Examples of such industries include pure service companies, where the focus is on providing services rather than tangible products.

Notable examples are accounting firms, law offices, and business consultants. While these entities incur various business expenses, their operations do not involve the production and sale of goods, leading to the exclusion of the cost of goods sold from their financial calculations.

Instead, these service-oriented industries utilize a distinct metric known as the cost of services to account for the direct expenses associated with delivering their specialized offerings.

This differentiation reflects the unique nature of their business models, highlighting the importance of tailoring financial calculations to the specific characteristics of each industry.

Are Operating Expenses Included in the Cost of Goods Sold?

Operating expenses are distinct from the cost of goods sold (COGS) and encompass general business costs that are not directly tied to the production of goods or services.

These expenses, detailed in the income statement, include general selling and administrative costs such as rental expenses, office supplies, legal fees, sales and marketing, administrators’ salaries, and insurance costs.

While essential for overall business operations, they are separate from the direct costs associated with producing goods or services.

COGS specifically focuses on the expenses directly related to the creation of products, providing a clear delineation between operational and production costs.

Are Salaries Considered a Cost of Goods Sold?

Salaries are typically excluded from calculating the cost of goods sold (COGS) and are categorized under operating expenses. This holds true in the majority of cases, reflecting the general distinction between direct production costs and broader business operational expenses.

However, exceptions arise when salaries are intricately tied to sales percentages. A prime example is the commissions paid to real estate brokers based on sales.

In such cases, where a direct correlation exists between the salary and generated revenues, these commissions are considered part of the company’s cost of goods sold.

This nuanced inclusion underscores the recognition of labor costs directly influencing the revenues generated by the business.

COGS Calculation: Complementary or Replacement for Other Accounting Methods?

While calculating the cost of goods sold is essential for monitoring direct costs and identifying potential cost-saving measures, it falls short of providing a comprehensive view of the company’s true sales costs.

It excludes critical elements such as marketing, salaries, rent, and administrative expenses. Moreover, it doesn’t account for fixed costs, leading to significant variations in the true cost per unit sold.

Additionally, the cost of goods sold can fluctuate with sales volumes, different sales periods, and inventory calculation methods. Relying solely on this metric may not accurately reflect the company’s profitability, emphasizing the need for a more holistic approach to financial analysis.

Use “Edara” to Accurately Calculate the Cost of Goods Sold

The process of calculating the cost of goods sold is integral to organizational financial management, particularly in connection with inventory evaluation.

“Edara”, a cloud ERP solution, proves to be an ideal tool for this task, addressing issues inherent in traditional inventory methods and providing significant cost, effort, and time savings.

In any organization, regardless of the inventory method employed, the ERP system, specifically “Edara,” facilitates a comprehensive view of goods. This includes details such as production date, sale date, classification, prices, and more, enhancing the accuracy of cost of goods sold calculations.

Choosing the right method for calculating the cost of goods sold is paramount for organizational success. Utilizing the expertise embedded in “Edara” ensures precision in these calculations and optimizes the benefits for the organization.

For further insights and assistance, feel free to contact us, and we’ll be glad to guide you through the process.

Related articles

Operating Costs Calculation: Unlocking Financial Health and Sustainability

Understanding operating costs calculation is crucial for any business, as it provides a clear picture of the financial health and sustainability of a project. In this article, we'll delve into…